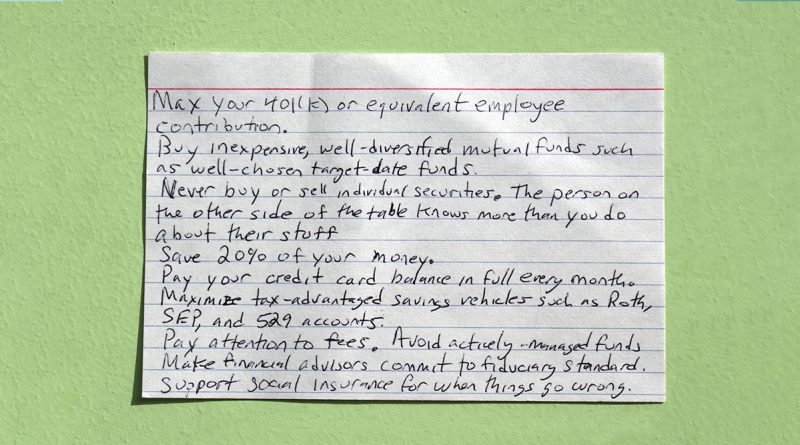

Simple Financial Advice from a 3×5 Index Card

Would you believe if I say that the best personal financial advice can fit into a 3-by-5 index card?

Probably not but, let me tell you that it’s 100% true.

There are numerous personal finance books, blogs, and articles out there. They offer you extensive guidance on investing, saving, retirement, and taxes.

All those books are available for you to read.

Or you can just have a look at this 3-by-5 index card and get all the financial knowledge you crave for.

Harold Pollack, a professor at the University of Chicago, created a 3×5-card that offered sound financial advice. Most people are aware of the majority of this information. However, the issue is that, despite having the data, we rarely use it. Going over financial advice may be tedious for some. But, it could save others from future difficulties. Let’s delve a little deeper into these no-nonsense pointers.

How did Pollack come up with this idea?

In 2013 April, Pollack did an interview with Olen about her book. During this, he noted that “the finest financial advice for most people would fit on an index card.” He further continued that if someone is paying for the advice, they are getting it wrong and irrelevant. It is because the correct advice is mostly very straightforward.

Pollack’s remark was not meant to be the focus of the interview. If anything, it was a one-off remark, and he didn’t go into detail about the financial advice.

However, it went viral after Pollack posted this video online. After that, he began receiving emails, asking where to get the index card and what the advice was.

So Pollack took an index card from his daughter. Then he scribbled a few financial ideas on it, took a picture with his phone, and put it online. This became popular right away.

Pollack’s 10 simple financial rules

After the success of the index card post, Pollack and Olen collaborated to write a book. It was The Index Card: Why Personal Advice Doesn’t Have To Be Complicated. They expanded on the simple financial advice that Pollack had written down on his index card. Also, he made a few modifications to it.

The personal finance advice is clear and uncomplicated, as the title says. Some regulations are unbreakable, while others are up for debate.

Here are Harold Pollack’s 9 real pieces of financial advice from his index card:

1️⃣ Employee is frequently offered 401(k) plans by their employers. Make the most of yours. Or at the very least give as much as you can to qualify for your company’s matching contribution. It can mean the difference between retiring and living a luxurious lifestyle or just scraping by.

2️⃣ Cheaper is usually preferable. Mutual funds and Target Date funds are substantially less expensive than managed funds. Therefore, you should go that route.

3️⃣ Individual securities should be handled by professionals. Stay away if that’s not you. On the other hand, the experts know more than you do.

4️⃣ It used to be that saving 10% of one’s income was the standard; nowadays, it’s 20%. Attempt to save as much as possible. You’ll be ready when an emergency or opportunity arises.

5️⃣ If you don’t pay off your credit card bill every month, you risk becoming a debt slave for life.

6️⃣ Do you want to save money on taxes? For tax advantages, use a 529 plan for your children, or a Roth or SEP account for yourself.

7️⃣ When buying actively-managed funds, fees can cut into your money. So, be sure you understand them.

8️⃣ Financial advisors agree to fiduciary standards in order to safeguard you. Make sure your counsel agrees to follow those guidelines.

9️⃣ It’s not a question of whether, but when things will go wrong. Support social insurance in times of need.

These are the simple and the most basic financial advice that one can ask for. Make sure you understand them and apply them to your future decisions to make the most out of your financial gains.