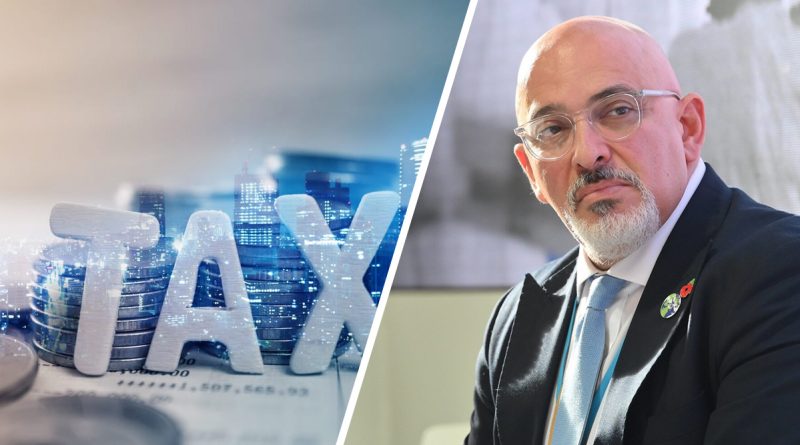

New UK Chancellor Will Review Corporate Tax Hikes

The new chancellor of the exchequer, Nadhim Zahawi, is getting his priorities as soon as he holds the position. Just hours after the appointment, he called for a review of the UK’s business tax policy. This gives a clear impression that a raise from 19p to 25p expected in 2019 would be scaled back or abandoned.

But, before we look into the details, let’s learn who Nadhim Zahawi is. Moreover, we’ll learn what significance he holds as the new Chancellor of the Exchequer.

Who is Nadhim Zahawi?

After the resignation of Rishi Sunak, UK Prime Minister Boris Johnson appointed Nadhim Zahawi as the new Chancellor of the Exchequer.

Zahawi, who was Kurdish and was born in Iraq, moved to the UK when he was nine years old after his parents fled Saddam Hussein’s rule.

He helped start the polling company YouGov after completing a chemical engineering degree at University College London. Besides, he is currently regarded as one of the wealthiest members of the House of Commons.

He worked as the Education Secretary after Gavin Williamson and was seen as a “safe set of hands.”

Zahawi’s stay in the position has not been without challenges. Moreover, in recent months he has been working to prevent teachers from going on strike. That, he has called “unforgivable” months after students returned to school after the pandemic’s disruption.

Not only that but under Theresa May, he worked as a junior minister of education. However, his allegiance to Boris Johnson has never really wavered. So, we see that Nadhim Zahawi is a man of experience who is going to look after Britain’s financial state.

Zahawi’s role as the new Chancellor of the Exchequer

As the government’s senior financial minister, the Chancellor of the Exchequer is in charge of managing public spending as well as generating money through taxes and borrowing. He is ultimately in charge of the Treasury’s operations.

The following are the Chancellor’s duties:

- Fiscal strategy (including the presenting of the annual Budget).

- Monetary policy, establishing targets for inflation.

- Governmental arrangements (in his role as Second Lord of the Treasury).

- Overall accountability for the Treasury’s COVID-19 response.

Nadhim Zahawi’s plan to review the corporate tax rises

As soon as Zahawi held his position, he said he wanted to look at the proposed rises in corporation tax. By this, he wants to ensure that British companies maintain their competitiveness,

He stated to Sky News that he will consider anything. Nothing is off the table. After all, one of the nations with the best investment climates is what he aspires to be.

He knows that boards around the world make long-term investment choices. Moreover, the one tax they can compare worldwide is corporation tax. However, he said, “as long as we practice financial restraint, I want to make sure we are as competitive as we can be.”

In a different interview with BBC, he added, “Of course, I will be looking at where else I can ensure the economy remains competitive and vibrant with our European neighbors and the whole world.”

Reasons why Nadhim Zahawi wants to rethink the corporate tax rises

According to Rishi Sunak, larger incentives for investment would imply that only those companies that failed to invest would face higher tax levels. He said this last year while announcing the corporate tax increase, the first since 1974.

On the other hand, former oil industry advisor Zahawi is well known for supporting reduced taxes. Besides, most recently he opposed a windfall tax on the North Sea oil and gas corporations. He told Sky that “rebuilding and growing the economy” was his first goal.

In a series of TV and radio interviews, he stressed that any expenditure plans should not distract from the necessity of limiting borrowing growth and reducing inflation. It can even include potential tax cuts.

The prime minister wants to guarantee the practice of fiscal restraint. “He and I both have that focus,” he told the BBC.

Moreover, he told Sky that the most crucial thing is to limit inflation and practice budgetary responsibility. So, the first thing they must do is ensure that they exercise extreme caution in all areas. It includes public sector pay, to prevent further fueling of inflation. Moreover, inflation is currently a worldwide battleground.

He expressed his worries about the sharp increase in borrowing costs during an interview on LBC Radio. “This year, we will service £83 billion in debt. It was £20 billion last year.”

He added that inflation is terribly, deeply detrimental if allowed to grow out of control. This condition is worse for most underprivileged families in society.